Contractors must engage with grid operators early to avoid delays in their developments, writes Barrett Harris.

Among the several challenges facing UK construction, getting a quick connection to the electricity grid is fast becoming another hurdle to overcome. Recent soaring demand for connections has put the grid under significant pressure, with backlogs leading to long wait times.

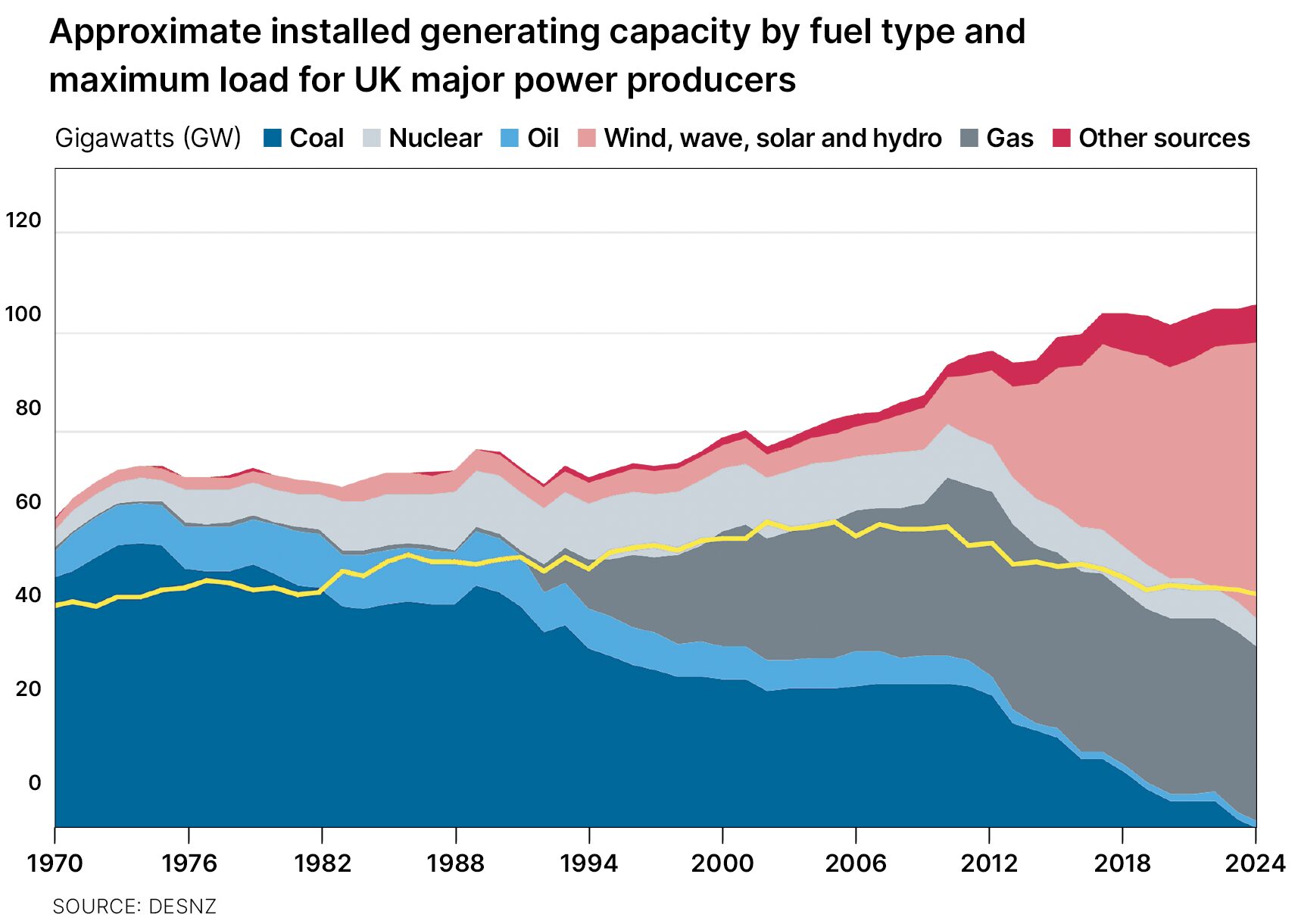

Over the past decade, installed generating capacity in the UK has consistently risen, driven by the expansion of offshore wind, solar and battery storage. By contrast, the highest level of electricity demand that was successfully supplied by major power producers (peak demand) remained relatively flat, due to efficiency gains and changing consumption patterns. The result is a system that, on paper, has more capacity than demand, as the following chart shows (below).

However, capacity type and location matter as much as the headline totals. Renewable generation is concentrated in specific regions, such as Scotland for wind and the south of England for solar.

563.3%

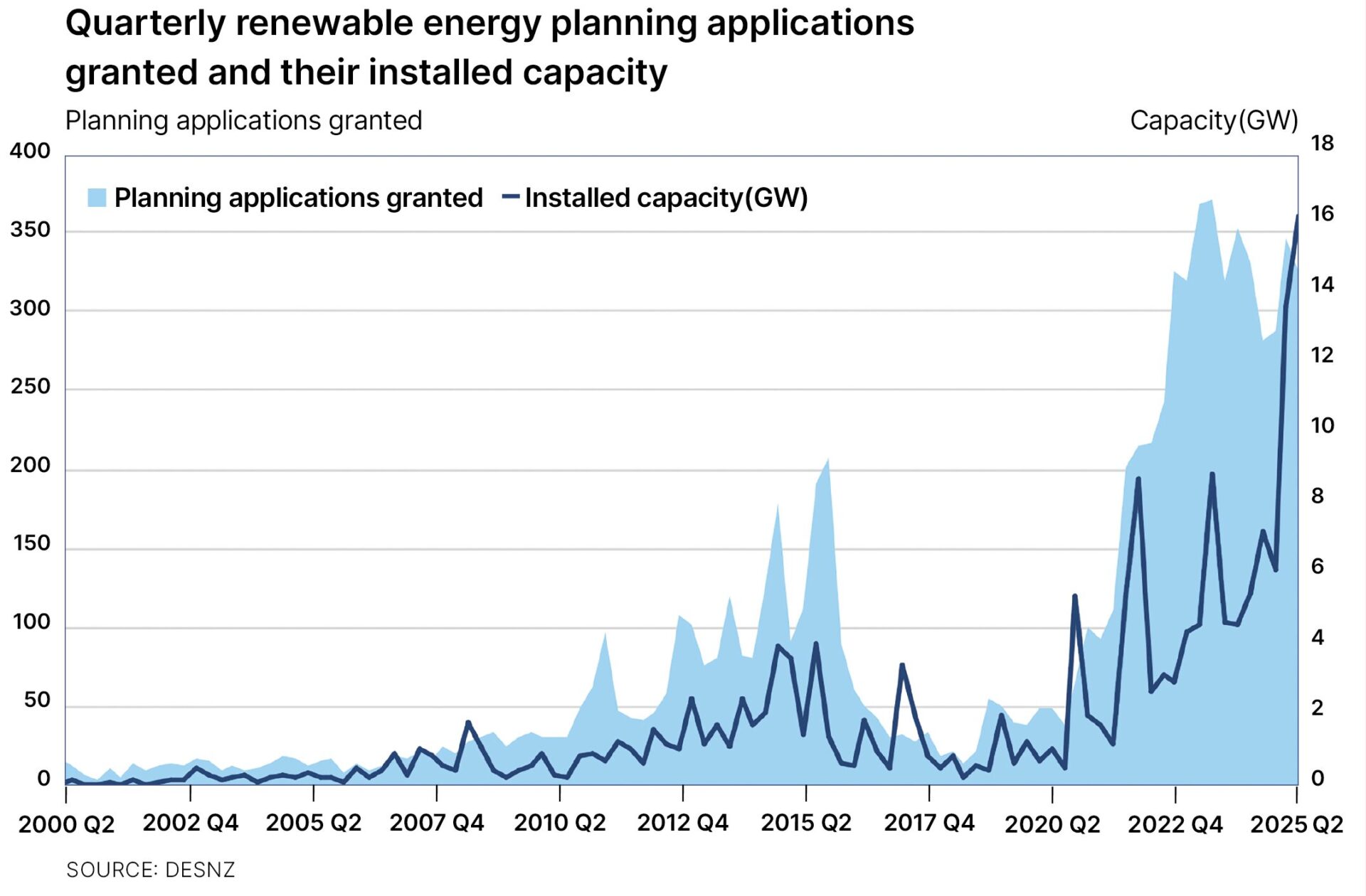

The percentage increase in granted renewable planning applications between 2020 Q2 and 2025 Q2.

Construction projects that depend on secure and high-voltage connections, like large industrial facilities or data centres, often face delays if local grid reinforcements lag behind the pace of new connections. This mismatch means that even with sufficient national capacity, local shortages can restrict development.

The most pressing challenge is the lengthening grid connection queue. Developers seeking to connect new power plants, battery storage or demand-intensive projects must apply for a grid connection agreement.

The volume of these applications has surged. In September 2023, 549 GW of projects held agreements according to Ofgem’s Connection Action Plan report. Energy Networks Association data show this had grown to 889 GW by June 2025.

Long timelines

This dramatic rise reflects both the surge of renewable proposals, many benefiting from expedited Department for Energy Security and Net Zero (DESNZ) planning consent and the growing interest in electrification of transport, housing and other sectors.

The following chart (below) illustrates the sharp 563.3% increase in granted renewable planning applications between 2020 Q2 and 2025 Q2, leading to a combined capacity of 110.2 GW.

For construction projects, the implication is clear: even if planning consent is secured, the lack of a timely grid connection can put projects on hold for years. Some developers now face connection dates well into the 2030s.

For the construction industry, grid constraints bring delays, cost pressures and shifting priorities. Projects can be held up for years awaiting substations or transmission upgrades, while grid reinforcement costs often run into tens of millions of pounds. Some developments are redesigned to lower peak demand through on‑site generation or storage.

However, reforms are under way. Ofgem and the National Energy System Operator are working to remove inactive ‘zombie’ projects and prioritise those ready to build, while grid reinforcement programmes ramp up. But timelines remain long.

As a result, energy infrastructure is now a core strategic consideration. Developers and contractors must engage with grid operators early, secure realistic connection dates and integrate energy resilience into designs from the outset.

As the UK moves toward net zero, the synchronisation of DESNZ’s planning momentum with the physical readiness of the grid will determine not only continuity of energy supply, but also how quickly new industries can scale and the communities that support them can be established.

Barrett Harris is a senior economic analyst at Turner & Townsend.

The post Off-grid: how energy infrastructure impacts construction projects appeared first on Construction Management.

View the original article and our Inspiration here

Leave a Reply