Dive Brief:

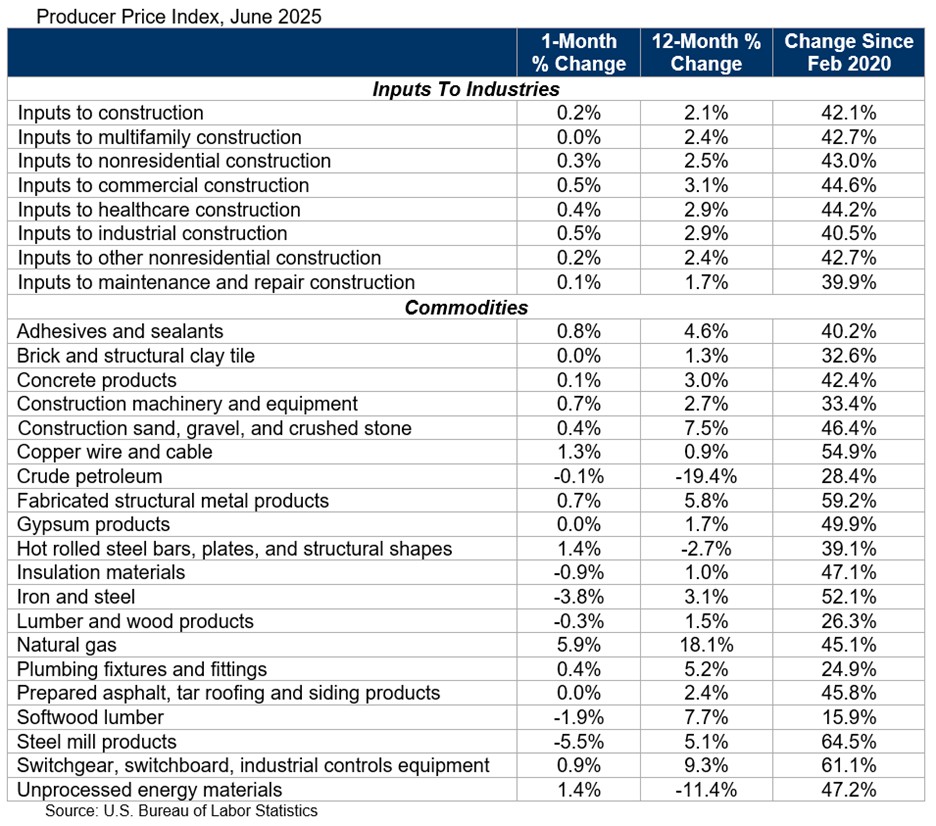

- Construction input prices ticked up 0.2% in June, driven by increases in key materials such as copper and fabricated structural metal products, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data.

- Input costs now sit 2.1% higher overall and 2.5% higher for nonresidential construction compared to a year ago, according to the report. Through the first half of 2025, nonresidential prices climbed at a 6% annualized rate.

- The June data predates the steepest tariffs set to take effect Aug. 1, leaving contractors bracing for more volatility as additional duties loom.

Dive Insight:

Contractors absorbed another round of steady cost increases in June, even before the most aggressive tariffs take hold later this summer, according to the Associated General Contractors of America.

Aluminum mill shapes climbed 6.3% over the past year, steel mill products rose 5.1% and lumber and wood products increased 4.8%, according to the report. More extreme increases hit certain structural steel components, including a 22.5% spike in fabricated metal for bridges and 8.3% for bar joists and rebar.

“The fact that construction materials prices are rising even before the steepest proposed tariffs have taken effect doesn’t bode well for what will happen in August if the promised new tariffs are implemented,” said Ken Simonson, AGC chief economist. “Rising construction costs and economic uncertainty are already causing some owners to put projects on hold, which will only get worse if costs jump again.”

The Trump administration raised steel and aluminum tariffs to 50% last month and plans to impose a similar 50% duty on copper on Aug. 1. Broader import restrictions also still remain under consideration.

At the same time, inflation appears once again to be gaining momentum. Core good prices, excluding automobiles, increased at their fastest pace since late 2021 in the June Consumer Price Index report, signaling additional risk for contractors on the horizon, said Anirban Basu, ABC chief economist.

“Nonresidential input price escalation has accelerated in 2025,” said Basu. “While it is unclear how and when trade policy will affect construction materials prices, the impact was evident in June’s CPI release.”

Nevertheless, Basu said many contractors remain upbeat about their margins. That outlook may reflect federal tax changes under the One Big Beautiful Bill Act, which made 100% bonus depreciation permanent and helped offset some pressure from rising input costs.

“Economic uncertainty remains extraordinarily elevated,” said Basu. “What is all but certain is that the Federal Reserve will not be cutting interest rates at its July meeting. Despite higher-for-longer interest rates and rising input prices, contractors remain relatively optimistic.”

Still, AGC officials warn confidence may erode if tariff-driven increases persist. If costs spike too sharply, more developers may choose to delay or cancel projects outright, according to the report.

“The construction industry is poised to benefit from greater tax certainty as well as the administration’s efforts to streamline permitting and reduce needless regulatory burdens,” said AGC CEO Jeffrey Shoaf in the release. “Finding a way to provide greater certainty on materials prices is the best way to make sure the new tax and regulatory approach have the best possible impact on economic activity.”

View the original article and our Inspiration here

Leave a Reply